GOBARdhan Scheme

Ministry of Drinking Water & Sanitation had launched the GOBAR (Galvanizing Organic Bio-Agro Resources) – DHAN scheme in 2018. The scheme is being implemented as part of the Swachh Bharat Mission (Gramin).

The Swachh Bharat Mission (Gramin) comprises two main components for creating clean villages –

- creating open defecation free (ODF) villages,

- managing solid and liquid waste in villages.

| India is home to the highest cattle population in the world, close to 300 million in number, with a daily output of 3 million tonnes of dung. |

Aim of the Scheme

- The scheme aims to augment income of farmers by converting biodegradable waste into compressed biogas (CBG).

- The initiative aims at attracting entrepreneurs for establishing community-based CBG plants in rural areas.

- The scheme aims to positively impact village cleanliness and generate wealth and energy from cattle and organic waste.

- The scheme also aims at creating new rural livelihood opportunities and enhancing income for farmers and other rural people.

Recently, the Unified Registration Portal for GOBARdhan was launched

- The Department of Drinking Water and Sanitation (DDWS), Ministry of Jal Shakti, has developed the portal to facilitate the setting up of Biogas/Compressed Biogas (CBG) plants.

- The portal acts as a one-stop repository for assessing investment and participation in the Biogas/CBG sector at the pan India level.

- Any government, cooperative, or private entity intending to set up a Biogas/CBG/Bio CNG plant in India can enroll in the portal and obtain a registration number.

Evergreening of Loans

An evergreen loan is a loan that does not require the repayment of principal during the life of the loan, or during a specified period of time. It is a practice of extending new or additional loans to a borrower who is unable to repay the existing loans, thereby concealing the true status of the non-performing assets (NPAs) or bad loans.

To avoid classifying a loan as an NPA, banks adopt the evergreening of loans. In the past, many banks had indulged in dressing up bad loans and given additional funds to companies who didn’t have the capacity to repay.

Non-Performing Asset

- A non performing asset (NPA) is a loan or advance for which the principal or interest payment remained overdue for a period of 90 days.

- In the case of agricultural loans, NPAs have declared if the interest and/or installment of principal remain unpaid for two harvest seasons.

- However, this period should not be longer than two years. Any unpaid loan/installment will be classified as NPA after two years.

- Banks are required to classify NPAs further into Substandard, Doubtful and Loss assets.

- Substandard assets: Assets which has remained NPA for a period less than or equal to 12 months.

- Doubtful assets: An asset would be classified as doubtful if it has remained in the substandard category for a period of 12 months.

- Loss assets: As per RBI, “Loss asset is considered uncollectible and of such little value that its continuance as a bankable asset is not warranted, although there may be some salvage or recovery value.”

- Gross and net NPA ratios have fallen from a high of 11.5 per cent and 6.1 per cent in March 2018 to 3.9 per cent and 1.0 per cent in March 2023 respectively.

Reserve Bank of India (RBI) Governor warnedabout banks adopting innovative methods for evergreening of loans – covering up the real status of stressed loans of corporates – to project an artificial clean image in cahoots with corporates. Banks have adopted various approaches like

- Selling and buying back loans or debt instruments between two lenders to avoid classifying them as NPAs.

- Persuading good borrowers to enter into structured deals with stressed borrowers to hide their default.

- Using internal or office accounts to adjust the repayment obligations of borrowers.

- Renewing or disbursing new loans to stressed borrowers or related entities closer to the repayment date of earlier loans.

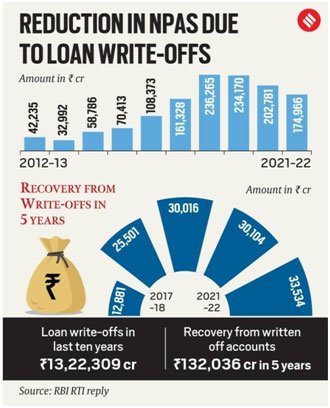

Writing Off Loans

- When a bank writes off a loan, it removes it from the bank’s asset book. This action is taken when the borrower has failed to repay the loan, and the chances of recovering the outstanding amount are very low.

- The defaulted loan, also known as NPA, is then transferred from the assets side and recorded as a loss.

- By writing off loans, a bank can reduce the level of non-performing assets (NPAs) on its books. Amount so written off reduces the bank’s tax liability.

- Even after the write-off, the bank is required to continue its efforts to recover the loan using various options. Provisioning must also be made for the written-off amount. As a result of the write-off, the bank’s tax liability is reduced as the written-off amount is deducted from the profit.

- Banks in India wrote off bad loans totalling more than ₹2.09 lakh crore during the FY23. This brings the total loan write-offs by the banking sector to a significant ₹10.57 lakh crore in the past five years.

Interest Coverage Ratio

- ICR is also known as times interest earned ratio. Interest Coverage Ratio = Company’s earnings before interest and taxes (EBIT)/interest expense. It measures how easily an entity could pay the interests against the outstanding dues it has. It allows investors, financial institutions and the market to understand the current ability of the firm to pay accumulated debts. Thus, in a way it depicts the financial health of a company.

- Earnings before interest and taxes (EBIT) is an indicator of a company’s profitability. EBIT defines a business’s net income and does not include its income tax or interest expenses.

- Lenders, investors, and creditors often use interest coverage ratio to determine a company’s riskiness relative to its current debt or for future borrowing.

- A low interest coverage ratio means company is less likely to pay its debt. Thus, a falling interest coverage ratio may give signal for future risk associated with a company.

- Higher the interest coverage ratio, healthier the financial situation of company i.e., it is more likely that company will pay its debts.

- Generally, a higher coverage ratio is better, although the ideal ratio may vary by industry.

Lightweight Payment and Settlement System

The Reserve Bank of India (RBI) recently announced plans to introduce a ‘Lightweight’ Payment and Settlement System (LPSS) for emergencies. RBI is calling it a “bunker” equivalent of digital payments, which can be operated from anywhere by a bare minimum staff in exigencies such as natural calamities or war.

The infrastructure for this system will be independent of the technologies that underlie the existing systems of payments such as UPI, NEFT, and RTGS. It aims to provide a portable and resilient solution during natural calamities and wartime situations.

Real-time gross settlement (RTGS), National Electronic Fund Transfer (NEFT), and Unified Payments Interface (UPI) are dependent on complex wired networks backed by advanced IT infrastructure. “However, catastrophic events like natural calamities and war have the potential to render these payment systems temporarily unavailable by disrupting the underlying information and communication infrastructure.

National Payment Corporation of India

- It is an initiative of the Reserve Bank of India (RBI) and the Indian Banks’ Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007, to create a robust Payment & Settlement Infrastructure in India.

- NPCI is promoted by ten major banks, including the State Bank of India, Punjab National Bank, Citibank, Bank of Baroda, and HSBC.

- Payment systems that the NPCI can operate include National Financial Switch (NFS), Immediate Payment System (IMPS), Aadhaar-enabled Payments System (AEPS) and National Automated Clearing House (NACH).

- Services Offered by NPCI:

- Bharat Bill Payment Interface (BBPI): It was developed by the NPCI to help the retail payments sector. With the introduction of the BBPI, a single platform has been made for aggregators and 0billpayers.

- Immediate Payment Service (IMPS): It gives you the option to transfer funds immediately. The facility is available at any given time. The beneficiary details must be added to transfer funds via IMPS. You can add the IFSC code and the account number to transfer funds via IMPS.

- RuPay: NPCI introduced RuPay so that average citizens can make financial decisions. RuPay is an affordable card and can be issued as credit cards, debit cards, and prepaid cards. More than 300 million RuPay cards are in India.

- USSD Services: Unstructured Supplementary Service Date (USSD) was introduced by the NPCI to allow individuals to make banking solutions without the need for the internet or smartphones.

- BHIM: BHIM uses UPI to complete payment transfers. You can make payments via BHIM by entering the Virtual Payment Address (VPA) or the registered mobile number. No smartphone is required to transfer funds via BHIM.

UPI: United Payments Interface (UPI) allows you to transfer funds from your smartphone. However, you will need to link your bank account to complete payments via UPI. Money is transferred directly from one bank to another.

Direct Seeding of Rice

The demand for rice is on the rise. Projections by the International Rice Research Institute (IRRI) anticipate rice production needs to increase by 25% in the next 25 years in order to meet global demand. To achieve this challenge in a sustainable way, we have to produce this extra rice more efficiently with less labor, water, energy, and agro-chemicals to reduce the environmental footprint of rice production.

Rice

- Some says that the word rice is derived from the Tamil word arisi. It is a kharif crop.

- Cultivation in India extends from 8 to 35ºN latitude and from below sea level to as high as 3000 meters.

- Rice crop needs a hot and humid climate.

- The average temperature required- from 21 to 37º C.

- In southern states and West Bengal the climatic conditions allow the cultivation of two or three crops of rice in an agricultural year.

About one-fourth of the total cropped area in India is under rice cultivation.

Current Method of Rice Cultivation

In traditional rice cultivation methods, 40% of the world’s irrigation water is applied for rice production.

- Broadcasting method – broadcasting is a method of seeding that involves scattering of seeds by hand over a relatively large area. In this method seeds are sown broadcast by hand and is practised in areas which are comparatively dry and less fertile in nature. It is useful in areas having less labour force to work the yields, it is the easiest method and requires minimum input and yields minimum level of output.

- Puddled Transplanted Rice (PTR) Method: in this method seeds are sown in a nursery and the seedlings are prepared there only. After 4 -5 weeks in the nursery the seedlings are uprooted and planted in the fields. It is a difficult method as everything is done by hand and requires heavy input. It is practised in areas having fertile soil, abundant rainfall and supply of labour. It also provides high yields.

- Japanese method – this method has been adopted successfully by the main rice producing area and is used to obtain high yields. In this method high yielding variants of seeds are used and heavy doses of fertilizers are also used. The seeds are sowed in a nursery and they are transplanted in rows so as to make weeding and fertilizing easy.

DSR Method

- Direct seeding is a crop establishment system wherein rice seeds are sown directly into the field, as opposed to the traditional method of growing seedlings in a nursery, then transplanting into flooded fields.

- In DSR as flooding of fields is not done during sowing, chemical herbicides are used to kill weeds.

- By eliminating the need for nursery cultivation, farmers save approximately 30 days in the crop cycle.

- According to the results from research trials and farmers’ field survey, after this technique the yield is one to two quintals per acre higher than puddled transplanted rice.

New Global Financing Pact Summit

The official agenda of the Summit was to “provide the opportunity to examine interactions between multilateral development bank reform, mobilisation of private capital, climate finance, green infrastructure and solutions related to debt” in order to achieve “a more balanced financial partnership between the North and South.”

India also participated.

The UNFCCC, Kyoto Protocol, and the Paris Agreement call for financial assistance from Parties with more financial resources (Developed Countries) to those that are less endowed and more vulnerable (Developing Countries).

This is in accordance with the principle of “Common but Differentiated Responsibility and Respective Capabilities” (CBDR).

International Financial System is changing

- New actors like India, China, Brazil are now key actors in international politics and economy.

- World is going through multiple crisis

- Debt crisis by low- and middle-income countries

- Poverty

- Inflation

- Climate Change

- Russia Ukraine Crisis

- Democratic backsliding

- Pandemic

- Economists estimated that the developing countries will require $2.4 trillion per year to cut emissions and deal with climate change.

- To address the existing and emerging shared concerns, poorer countries from the Global South (such as Zambia, Senegal, Kenya, among others) are keen on renegotiating the terms of international finance.

Barbados led Bridgetown Initiative

The key demands of the BI are

- UN member states should fast track the transfer of $100 bn – Special Drawing Rights – to programmes that support climate resilience and subsidise lending to low-income countries.

- The SDR is an international reserve asset created by the IMF to supplement the official reserves of its member countries. The SDR is not a currency.

- IMF should suspend surcharge imposed on heavily indebted borrowing countries for 2-3 years.

- Enhanced access limits must be restored in Rapid Credit Facility and Rapid Financing Instruments.

- G20 creditor countries should redesign their Common Framework for restructuring the debt of poor countries in default.

- Public and private creditors should include disaster clauses in lending deals to allow countries to divert debt payments to disaster relief.

- U.N. member states should agree to raise $100 billion a year for a fund to help pay for the climate-related loss and damage suffered by developing countries.

Takeaway from Summit

- The Summit announced the unlocking of an additional USD 200 billion lending capacity for emerging economies. The World Bank introduced disaster clauses to suspend debt payments during extreme weather events.

- The IMF announced the allocation of USD 100 billion in SDRs (Special Drawing Rights) for vulnerable countries, although some SDRs still require approval from the US Congress.

- The EU called for increased coverage of global emissions by Carbon Pricing Mechanisms and allocating a portion of revenues to climate finance.

- The Summit indicated that the long-awaited USD 100 billion climate finance goal would be achieved this year.This commitment was made at UNFCCC COP 15 in Copenhagen in 2009.

The Addis Ababa Action Agenda 2015

- It provides a foundation for implementing the global sustainable development agenda. Financing is considered the linchpin for the success of the new sustainable development agenda, which will be driven by the implementation of 17 sustainable development goals.

- The Addis Ababa Action Agenda includes important policy commitments and key deliverables in critical areas of sustainable development, including infrastructure, social protection and technology.

Loss and Damage Clause, 2022

At CoP 27 in Sharm el-Sheikh, Loss and Damage fund was established to compensate the most vulnerable countries for damages from climate-linked disasters