Mains – 28th Nov 23

Internationalisation of the rupee

Why in news?

- A Reserve Bank of India-appointed working group recommended various measures to accelerate the pace of internationalisation of the rupee. This included inclusion of the rupee in the Special Drawing Rights (SDR) basket and recalibration of the foreign portfolio investor (FPI) regime.

What is an International Currency?

- A currency can be termed “international” if it is widely accepted worldwide as a medium of exchange. Just like a domestic currency, an international currency performs the three functions of money – as a medium of exchange, a unit of account, and a store of value.

What is Currency Internationalization?

- Currency internationalization is the use of a currency outside the borders of its country of issue. The level of currency internationalization for a currency is determined by the demand that users in other countries have for that currency.

- The US dollar has been the dominant global currency for the better part of the last century. Its position is supported by a range of factors, including the size of the US economy, the reach of its trade and financial networks, the depth and liquidity of US financial markets, and a history of macroeconomic stability and currency convertibility.

Benefits of Currency Internationalization:

- Limit Exchange Rate Risk: As the internationalisation of a country’s currency broadens and deepens its financial market, domestic firms may be able to invoice and settle their exports/imports in their currency, thus shifting exchange rate risk to their foreign counterparts.

- Access to international financial markets: It permits domestic firms and financial institutions to access international financial markets without assuming exchange rate risk.

- New opportunities: It offers new profit opportunities to financial institutions, although this benefit may be offset in part by the entry of foreign financial institutions into the domestic financial market (to the extent that the government permits it).

- Boost capital formation: A larger, more efficient financial sector may serve the domestic non-financial sector better by reducing the cost of capital and widening the set of financial institutions that are willing and able to provide capital. This would boost capital formation in the economy thereby increasing growth and reducing unemployment.

- Finance Budget Deficit of Government: Currency internationalisation may, of course, allow a country’s government to finance part of its budget deficit by issuing domestic currency debt in international markets rather than issuing foreign currency instruments.

- Foreign exchange reserves: The internationalisation of a currency reduces the requirement for the authorities to maintain and depend on large foreign exchange reserves in convertible currencies to manage external vulnerabilities.

- Repay external sovereign debt: At the macroeconomic level, internationalisation of a currency results in lowering the impact of sudden stops and reversals of capital flows and enhances the ability to repay external sovereign debt.

Challenges:

- Conflict with domestic monetary policy: The obligation of a country to supply its currency to meet the global demand may come in conflict with its domestic monetary policies, popularly known as the Triffin dilemma.

- Highlight external shocks: The internationalisation of a currency may accentuate an external shock, given the open channel of the flow of funds into and out of the country and from one currency to another.

- Exchange rate volatility: The costs also emanate from the additional demand for money and also an increase in the volatility of the demand. With the advances in statistical reporting, most central banks can separate foreign demand for money, but with regard to some components, such as cash, uncertainty remains. The main costs of allowing greater international use of the currency emerge from the possible increased volatility in the exchange and money markets, thus making the conduct of monetary policy more complex.

What is Internationalisation of the rupee?

- Internationalisation of the rupee is a process that involves increasing use of the local currency in cross-border transactions. Basically, it is a process of promoting and increasing the use of the INR as a widely accepted currency for international transactions and investments. It involves enhancing the currency’s acceptance, liquidity, and usability in global markets.

Can the Rupee become an International Currency?

- During the last two decades, India has emerged as one of the world’s fastest growing economies and also a preferred destination for global investors. The Indian economy has also shown remarkable resilience against adverse global developments, especially during the COVID-19 pandemic.

- There is some anecdotal evidence that INR is accepted to some extent in Singapore, Malaysia, Indonesia, Hong Kong, Sri Lanka, United Arab Emirates (UAE), Kuwait, Oman, Qatar and the United Kingdom (UK), among others, while it is legal tender in Nepal and Bhutan.

- Looking ahead, the conditions seem opportune for the emergence of INR as an international currency. It is argued that the bilateral currency swap arrangements may provide a blueprint for reducing the dependence on the US dollar for settling trade transactions.

Steps taken to promote international trade settlement in rupees:

- In July 2022, the RBI has provided an additional arrangement for invoicing, payment, and settlement of exports/imports in the rupee.

- As part of this mechanism, in December 2022, India saw its first settlement of foreign trade in rupee with Russia.

- So far banks of 19 countries including the UK, New Zealand, Germany, Malaysia, Israel, and the United Arab Emirates have been permitted to make settlements in rupees.

RBI panel recommends measures for internationalisation of rupee:

- Rupee has the potential to become an internationalised currency. India is one of the fastest growing countries and has shown remarkable resilience even in the face of major headwinds. Higher usage of the rupee in invoicing and settlement of international trade, as well as in capital account transactions, will give the domestic current a progressively international presence.

- The recommendations have been divided as per the expected time required for implementation. The timeframe of these recommendations has been determined based on the institutional capacity, macroeconomic priority and suitability of accompanying prerequisites.

Short Term:

- Designing a template and adopting a standardised approach for examining the proposals on bilateral and multilateral trade arrangements for invoicing, settlement and payment in INR and local currencies.

- Making efforts to enable INR as an additional settlement currency in existing multilateral mechanisms such as Asian Clearing Union (ACU).

- Facilitating Local Currency Settlement (LCS) framework for bilateral transactions and operationalising bilateral swap arrangements with the counterpart countries in local currencies.

- Encouraging opening of INR accounts for non-residents (other than nostro accounts of overseas banks) both in India and outside India.

- Integrating Indian payment systems with other countries for cross-border transactions.

- Strengthening financial markets by fostering a global 24×5 INR market and promoting India as the hub for INR transactions and price discovery.

- Providing equitable incentives to exporters for INR trade settlement.

| Asian Clearing Union (ACU):

· ACU is a regional payment and settlement system that facilitates trade and financial transactions among member countries in Asia. · It was established in 1974 with the aim of promoting intra-regional trade and enhancing economic cooperation among its members. · Members – Bangladesh, Bhutan, India, Iran, Myanmar, Nepal, Pakistan, the Maldives, and Sri Lanka. Local Currency Settlement (LCS) System: · LCS is a cross border payment mechanism which allows trading entities from two countries to make payments in their own national currencies. · Unlike the multilateral settlement system that is followed under the Bretton Woods System, the LCS are largely bilateral agreements and arrangements, (exception -involving trade blocs). · Under LCS, in contrast to the existing practice of using a reserve or hard currency like the US Dollar, payments for imports and exports are done through the currencies of the respective trade partners.

Nostro/Vostro Account:

|

Medium Term:

- A review of taxes on Masala bonds.

- International use of Real Time Gross Settlement (RTGS) for cross border trade transactions and inclusion of INR as a direct settlement currency in the Continuous Linked Settlement (CLS) system.

- Examination of taxation issues in financial markets to harmonise tax regimes of India and other financial centres.

- Allowing banking services in INR outside India through off-shore branches of Indian banks.

| Masala Bonds:

· Masala bonds, also known as rupee-denominated bonds, are debt instruments issued by non-Indian entities in the international market but denominated in Indian rupees (INR). · The term “masala” is derived from the Indian cuisine, symbolizing the bond’s connection to India. · Masala bonds provide a means for foreign entities to raise funds in Indian currency from global investors. These bonds are typically listed on international exchanges, allowing investors outside of India to participate in the Indian debt market.

Real Time Gross Settlement (RTGS): · RTGS is a system where there is continuous and real-time settlement of fund-transfers, individually on a transaction-by-transaction basis (without netting). · ‘Real Time’ means the processing of instructions at the time they are received; ‘Gross Settlement’ means that the settlement of funds transfer instructions occurs individually.

What are the benefits of using RTGS? · It is a safe and secure system for funds transfer. · RTGS transactions / transfers have no amount cap set by RBI. · The system is available on all days on 24x7x365 basis. There is real time transfer of funds to the beneficiary account. · The remitter need not use a physical cheque or a demand draft. · The beneficiary need not visit a bank branch for depositing the paper instruments. · The beneficiary need not be apprehensive about loss / theft of physical instruments or the likelihood of fraudulent encashment thereof. · Remitter can initiate the remittances from his / her home / place of work using internet banking, if his / her bank offers such service. · The transaction charges have been capped by RBI. · The transaction has legal backing.

How is the processing of RTGS different from that of National Electronic Funds Transfer (NEFT) System? · NEFT is an electronic fund transfer system in which the transactions received up to a particular time are processed in batches. Contrary to this, in RTGS, the transactions are processed continuously on a transaction-by-transaction basis throughout the day.

Is there any minimum / maximum amount stipulation for RTGS transactions? · The RTGS system is primarily meant for large value transactions. The minimum amount to be remitted through RTGS is ₹ 2,00,000/- with no upper or maximum ceiling.

Continuous Linked Settlement (CLS) system: · The Continuous Linked Settlement (CLS) system is a global financial infrastructure that provides secure and efficient settlement services for foreign exchange (FX) transactions. It was established to mitigate settlement risk in the FX market and enhance stability in the global financial system.

|

Long Term:

- Over the long term, India will achieve higher levels of trade linkages with other countries and improved macro-economic parameters, and INR may ascend to a level where it would be widely used and preferred by other economies as a “vehicle currency”. Thus, in the long run, efforts should be made for inclusion of INR in the IMF’s Special Drawing Rights (SDR) basket.

| What is Special Drawing Rights (SDR)?

· The SDR is an international reserve asset, created by the IMF in 1969 to supplement its member countries’ official reserves. The IMF uses SDRs for internal accounting purposes. It should be noted that SDRs are neither a currency nor a financial claim on the IMF. SDRs are a potential claim of IMF members on freely usable currencies.

Basket of currencies determining the value of the SDR: · The value of the SDR is based on a basket of five currencies. · These currencies are – the U.S. dollar, the euro, the Chinese renminbi, the Japanese yen, and the British pound sterling. · Currencies included in the SDR basket have to meet two criteria: the export criterion and the freely usable criterion. · The value of the SDR is determined on daily basis. It is based on weighted market exchange rates of the basket currencies.

SDR Allocation: · SDRs are allocated to each of the countries that are IMF members. · The amount of SDRs that are allocated to each country is based on their individual IMF quotas. Ø IMF quotas are based broadly on the relative economic position of the country in the world economy. Ø The quota is essentially a country’s financial commitment to the IMF and its voting power. · The IMF determines whether there is a need for a new allocation of SDRs in the global economy every five years. The recent allocation was done in August 2021.

|

Way Forward:

- Overall, the benefits of internationalisation in terms of limited exchange rate risk, lower cost of capital due to better access to international financial markets, and reduced requirement of foreign exchange reserves far outweigh the concerns.

- Further, as the internationalisation of a currency is a long-drawn process involving continuous change and incremental progress, it would enable timely redressal of the associated concerns and challenges as we move forward.

Financial Action Task Force (FATF)

Why in News?

India may benefit from the Delhi High Court’s decision that US online payment processor PayPal qualifies as a “reporting entity” for purposes of the anti-money laundering law when the FATF evaluates its anti-black money system.

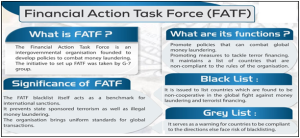

What is the Financial Action Task Force (FATF)?

- It is an intergovernmental organisation founded in 1989 to develop policies to combat money laundering and its mandate was expanded to include terror financing in 2001.

- It operates from Organisation for Economic Cooperation and Development (OECD) headquarters in Paris and its plenary/ decision-making body meets three times per year.

- FATF’s mandate –

- Recognises the need to continue to lead decisive, coordinated and effective global action to counter the threats of the abuse of the financial system by criminals and terrorists, and

- Strengthens its capacity to respond to these threats that all countries face.

- It has 39 members including India (became observer in 2006 and a full-time member in 2010) and two regional organisations – the EU and GCC (Gulf cooperation council).

- The FATF conducts peer reviews of each member on an ongoing basis to assess levels of implementation of the FATF Recommendations.

- It provides an in-depth description and analysis of each country’s system for preventing criminal abuse of the financial system.

- India is currently under the FATF review. It last underwent a similar review in 2013 where it was found that India had reached a satisfactory level of compliance with all of the core and key recommendations of the watchdog.

Delhi HC’s Verdict

- It had set aside a penalty of Rs 96 lakh imposed on PayPal by the Financial Intelligence Unit (FIU) – India for alleged non-compliance with the reporting obligations under the law against money laundering.

- However, it ruled that PayPal was liable to be viewed as a payment system operator under the Prevention of Money Laundering Act (PMLA) and so has to comply with reporting obligations under the law.

- The categorisation of PayPal as a reporting entity under the PMLA will ensure that –

- All such big payment gateways and platforms are regulated and

- They share the stipulated suspicious transaction reports (STRs) and cross-border wire transfer reports with the FIU under the PMLA.

- The FIU disseminates these reportsto various probe agencies which investigate money laundering, tax evasion, and other serious financial frauds.

How will the Delhi HC Verdict help India during FATF Review?

- The judgement will help FIU bring operations of about a dozen more such payment gateways under the ‘reporting entity’ regime even as a number of payment gateways operating in the country are already reporting STRs to the FIU.

- While the judgement may not give India additional points during the FATF review, it will surely underline that –

- Indian anti-money laundering agencies are leaving no stone unturned.

- The country’s economic channels are clean and the risks of financial crimes are minimal.