Ozone Hole Over Antarctic

Ozone Hole Over Antarctic

What is Ozone layer:

The layer of Ozone gas found in Stratosphere, often referred to as “good ozone,” functions as a protective gas shield. It absorbs harmful ultraviolet (UV) radiation, playing a crucial role in shielding us from the detrimental effects of excessive UV exposure. The preservation of the ozone layer is vital in mitigating the impact of UV radiation on skin cancer rates.

Ozone Hole over Antarctica:

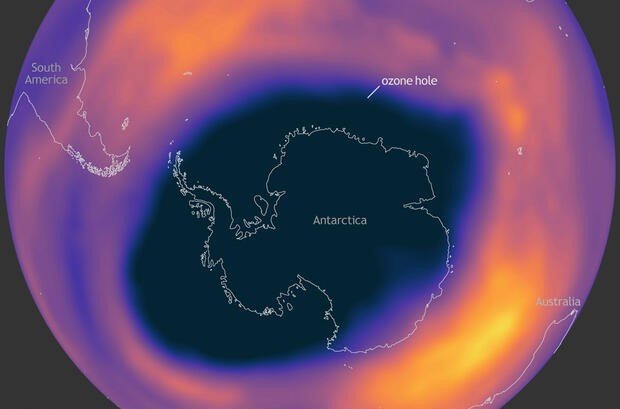

- An ozone hole refers to a section of the stratosphere above Antarctica where the ozone layer experiences significant depletion.

- The term “hole” is used metaphorically, as it doesn’t imply a complete absence of ozone. Instead, scientists use it to describe the area where ozone concentrations fall below the historical threshold of 220 Dobson Units.

- The dimensions of the ozone hole over Antarctica change annually, usually emerging in August and closing by November or December.

- This yearly variation is influenced by distinct climatic conditions specific to the region

How ozone hole is formed:

- The opening of the ozone hole is a result of the Earth’s Rotation, which generates specific winds over the enclosed landmass of Antarctica.

- The polar vortex, a band of strong winds around the poles, plays a vital role in ozone hole dynamics.

- During winter, polar vortex forms due to temperature differences and acts as a protective barrier, keeping polar air separate from warmer, lower-latitude air.

- This isolation creates a cold environment for polar stratospheric clouds (PSCs), which trigger ozone-depleting reactions.

- The chemical reactions that occur on the surface of PSCs are responsible for the activation of chlorine and bromine compounds. These compounds, particularly chlorine, are catalysts in ozone-depleting reactions. When exposed to sunlight, they trigger the breakdown of ozone molecules.

- This isolation creates a cold environment for polar stratospheric clouds (PSCs), which trigger ozone-depleting reactions.

- The size and strength of the polar vortex directly impact ozone depletion. When it weakens in spring, mixing with warmer air from lower latitudes gradually closes the ozone hole, replenishing the ozone layer.

Important Prelims Pointers:

§ While the Antarctic ozone hole in 2023 is likely linked to a natural event, it’s essential to acknowledge that in the 1970s, human activities, specifically the widespread use of chemicals called chlorofluorocarbons (CFCs), were responsible for significant ozone depletion. § The use of these gasses as propellants in aerosol cans released chlorine into the stratosphere, contributing to ozone depletion

|

Recent causes of Ozone hole:

- Scientists suspect that the substantial ozone hole observed in 2023 may be attributed to Tonga Volcanic eruption during December 2022 and January 2023.

- Unlike conventional volcanic eruptions, which generally release gasses confined to the lower atmosphere, this eruption propelled a significant amount of water vapor into the stratosphere.

- This water vapor, in addition to other ozone-depleting elements like bromine and iodine, impacted the ozone layer through chemical reactions, altering its heating rate.

GST Amnesty Scheme

About the Scheme:

- The scheme will remain open until January 31, 2024.

- It is applicable to entities that couldn’t submit their appeals against orders issued by the tax officer on or before March 31.

- The scheme is designed to assist those who missed the appeal filing deadline for reasons such as administrative errors or unforeseen circumstances.

- Entities opting for the scheme will be required to pre-deposit 12.5 percent of the tax demand, up from the previous 10 percent.

Significance:

- This initiative has the potential to enhance compliance among taxpayers. An approach that is fair and lenient toward appeal filing encourages better cooperation with tax authorities and a willingness to resolve disputes or clarify tax matters.

- Moreover, by facilitating more efficient dispute resolution, the scheme may alleviate the burden on the legal system, benefiting both taxpayers and the tax administration by streamlining the appeal process and potentially reducing the need for legal intervention.

Major Key Points:

Extension of Appeal Filing Deadline:

Taxpayers now have an extended timeframe until January 31, 2024, to file appeals against demand orders associated with the Goods and Services Tax (GST). This extension follows decisions made during the 52nd Goods and Services Tax Council meeting.

Pre-Deposit Requirements:

To benefit from the scheme, taxpayers must make a pre-deposit of 12.5% of the tax amount in dispute. A minimum of 20% of the tax under dispute (equivalent to 2.5% of the tax amount) must be debited from the electronic cash ledger, potentially impacting the working capital positions of businesses.

Coverage and Conditions:

- The scheme applies to cases where the appeal was not filed within the prescribed time frame under Section 107 of the CGST Act, 2017, for demand orders issued on or before March 31, 2023.

- Appeals can be filed in cases involving tax liability, interest, and penalty, excluding situations solely related to interest, fines, and penalties.

Scope of Sections 73 and 74:

Sections 73 and 74 are relevant in scenarios where the tax department identifies discrepancies such as tax shortfalls, non-payment, wrongful refund of input tax credit, or alleged misstatement or suppression of facts.

Exclusions from the Amnesty Scheme:

- Assessment orders issued under Sections 62, 63, and 64, primarily impacting non-registered entities or non-filers of returns, are not covered by the amnesty scheme.

- The introduction of this scheme is anticipated to provide relief to taxpayers facing challenges in timely appeal filings and facilitate smoother dispute resolution within the GST framework.

About GST:

GST, or Goods and Services Tax, is a comprehensive indirect tax levied on the supply of goods and services across India.

Here are some key points that describe GST:

- Indirect Tax System: GST is an indirect tax that has replaced various indirect taxes previously levied by the central and state governments.

- Implementation Date: The GST Act was passed by the Indian Parliament on March 29, 2017, and it came into effect on July 1, 2017.

- Unified Tax Law: It serves as a unified tax law for the entire country, streamlining the taxation process and reducing the complexity of the previous tax system.

- Multi-Stage Taxation: GST is a multi-stage tax, meaning it is applicable at every step of the supply chain, from the production or manufacturing stage to the final sale to the consumer.

- Destination-Based Tax: It is a destination-based tax, implying that the tax is levied based on the location of the consumption of goods or services rather than the location of their production.

- Dual Taxation Structure: In the case of intra-state sales, GST is bifurcated into two components – Central GST (CGST) levied by the central government and State GST (SGST) imposed by the respective state governments. For inter-state sales, Integrated GST (IGST) is charged by the central government.

The Goods and Services Tax (GST) system in India consists of three main components, each administered by different levels of government:

- CGST (Central Goods and Services Tax): This tax is collected by the Central Government on transactions within a single state. For example, if a transaction occurs within Maharashtra, CGST will be levied.

- SGST (State Goods and Services Tax): It is the tax collected by the State Government on intra-state transactions. For instance, when a transaction takes place within Maharashtra, the state government levies SGST.

- IGST (Integrated Goods and Services Tax): IGST is imposed by the Central Government on inter-state transactions. For instance, if goods are sold from Maharashtra to Tamil Nadu, IGST will be collected by the central government.

|

GST Appellate Tribunal:

|

Central Adoption Resource Authority (CARA)

About:

- The Central Adoption Resource Authority (CARA) operates as a statutory body under the Ministry of Women and Child Development.

- It serves as the central authority for the adoption of Indian children and is entrusted with the responsibility of overseeing and regulating both in-country and inter-country adoptions.

- CARA holds the designation of the Central Authority for managing inter-country adoptions, aligning with the provisions outlined in the Hague Conventions on Inter-Country Adoptions in 1993, which the Government of India ratified in 2003.

- CARA primarily focuses on facilitating the adoption of orphaned, abandoned, and surrendered children through its affiliated and recognized adoption agencies

Laws Related to Adoption in India:

- Adoptions in India are governed by two laws:

- the Hindu Adoption and Maintenance Act, 1956 (HAMA) and the Juvenile Justice Act, 2015.

- Both laws have their separate eligibility criteria for adoptive parents.

- Those applying under the JJ Act have to register on CARA’s portal after which a specialised adoption agency carries out a home study report.

- After it finds the candidate eligible for adoption, a child declared legally free for adoption is referred to the applicant.

- Under HAMA, a “dattaka hom” ceremony or an adoption deed or a court order is sufficient to obtain irrevocable adoption rights.

- Hindus, Buddhists, Jains, and Sikhs are legalized to adopt kids under this Act.

Hague Convention on the Civil Aspects of International Child Abduction

- Hague Convention is a multilateral treaty which came into existence on 1st December 1983.

- It is an international treaty to ensure the prompt return of the child who has been “abducted” from the country of their “habitual residence”.

- The Convention applies to children age under 16 years

Eligibility criteria for prospective adoptive parents:

- The prospective adoptive parents shall be physically, mentally and emotionally stable, financially capable and shall not have any life-threatening medical condition.

- Any prospective adoptive parents, irrespective of his marital status and whether or not he has biological son or daughter, can adopt a child subject to following, namely: –

- the consent of both the spouses for the adoption shall be required, in case of a married couple;

- a single female can adopt a child of any gender;

- a single male shall not be eligible to adopt a girl child;

- No child shall be given in adoption to a couple unless they have at least two years of stable marital relationship.

- The minimum age difference between the child and either of the prospective adoptive parents shall not be less than twenty-five years.

- The age criteria for prospective adoptive parents shall not be applicable in case of relative adoptions and adoption by step-parent.

- Couples with three or more children shall not be considered for adoption except in case of special need children.

Read More:

New Global Financing Pact Summit